Viziv Technologies centers around inventive energy move arrangements. They work in remote power frameworks with likely applications in different enterprises. The organization means to change energy conveyance. Their technology looks to further develop productivity and maintainability.

Is it true that you are interested in putting resources into state-of-the-art energy arrangements? Viziv Technologies offers a thrilling and open door for future innovative minds. Their noteworthy frameworks are acquiring consideration in the tech world. Could this be your next shrewd speculation?

Putting resources into Viziv Technologies could adjust you to an organization pushing limits in clean energy. They are devoted to making remote power frameworks that improve worldwide energy access. While promising, contributing implies gambles, so it is vital to research their advancement.

What Is Viziv Technologies?

Viziv Technologies is a creative energy organization. They center around remote power transmission frameworks. Their technology expects to change energy dispersion. It tries to diminish energy misfortune and lift productivity.

The objective is to make power available around the world. Their work upholds cleaner and reasonable energy arrangements. Viziv is earning respect for its state-of-the-art innovations. They are molding the eventual fate of energy move.

Can You Invest in Viziv Technologies?

Putting resources into Viziv Technologies is conceivable, research is vital. The organization centers around remote energy advancements. They are exclusive, so choices might shift. You could investigate investment or confidential financing.

Also Read This Blog: What Is Technology/Computers In Spanish

Their market potential is connected to practical energy interests. Think about the dangers, as technology speculations can be unsure. Continuously survey their advancement and look for master counsel before money management.

Public Status or Private Status

Public status implies an organization is exchanged on stock trades. Confidential status implies it remains exclusive. Both enjoy one-of-a-kind benefits and difficulties.

- Public organizations have more admittance to capital.

- Privately owned businesses keep up with more control and adaptability.

- Public status offers more noteworthy straightforwardness to financial backers.

Direct Investment

Direct Investment includes placing cash into a business or resource. It permits you to possess a stake and advantage from its development. This kind of speculation can offer significant yields yet additionally accompanies gambles.

- Direct ventures give you control and possession.

- It implies a higher gamble yet can give more noteworthy prizes.

- You can put resources into stocks, land, or privately owned businesses.

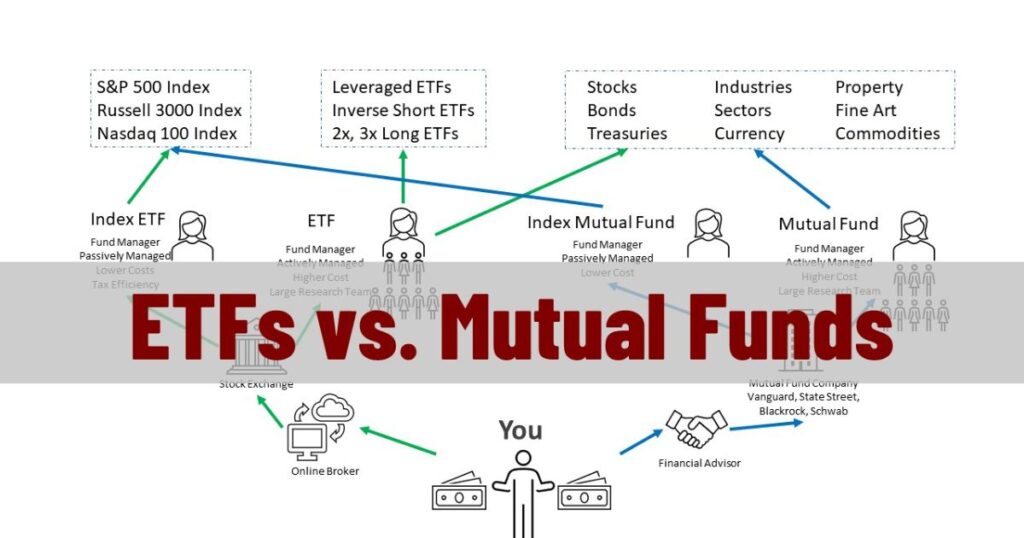

Indirect Investment

Indirect investment includes placing cash into resources through middlepeople. It offers a method for effective money management without claiming resources straightforwardly. This sort of speculation can be safer and more adaptable.

- Contribute through assets, stocks, or ETFs.

- Access a differentiated portfolio with less exertion.

- Benefit from proficient administration and techniques.

Why Invest in Viziv Technologies?

Putting resources into Viziv Technologies offers an opportunity to help development. They center around remote power arrangements with worldwide potential. Their technology intends to further develop energy effectiveness and supportability.

This lines up with developing clean energy requests around the world. Viziv is at the front of state-of-the-art headways. Their vision could reshape how energy is sent. It’s a promising and open door for groundbreaking financial backers.

Advanced Technology

Advanced technology technology is reshaping the way that we live and work. It carries shrewd answers for regular issues. Developments like artificial intelligence, mechanical technology, and IoT lead the change. These instruments make processes quicker and more effective.

Advanced technology innovation helps ventures like medical services and training. It likewise associates individuals around the world continuously. While it offers many advantages, it requires capable use. The fate of trend-setting innovation guarantees boundless conceivable outcomes.

Global Markets

Global Markets sectors interface with organizations and purchasers around the world. They empower exchange across borders consistently. Items and administrations stream between countries day to day. These business sectors drive financial development and advancement.

Technology has made worldwide exchange quicker and simpler. Cash trade and different guidelines add intricacy. Worldwide business sectors likewise set out open doors for speculations. They are the foundation of the advanced worldwide economy.

Market Potential

Market Potential alludes to the learning experiences in a particular industry. It features the interest for items or administrations. Understanding business sector potential assists organizations with focusing on their crowd. A solid market potential can prompt higher benefits.

Organizations evaluate this by dissecting patterns and client needs. It distinguishes holes and neglected requests. With the right methodologies, organizations can take advantage of undiscovered business sectors. The market potential frequently drives development and long-haul achievement.

How to Access VC Opportunities

Getting to investment (VC) potential open doors begins with systems administration. Go to industry occasions and interface with financial backers. Construct serious areas of strength for an arrangement that grandstands your vision. Try out your thoughts plainly and without hesitation to VCs.

Don’t miss to read out this blog: Is Hardware Technology Important For Cybersecurity

Join startup hatcheries or gas pedals to acquire openness. Use online stages that associate business visionaries and financial backers. Consider looking for tutors who can acquaint you with VC firms. With steadiness and arrangement, getting VC subsidizing turns out to be more feasible.

Accredited Investor Status

Accredited investor backer status permits admittance to select ventures with amazing open doors. It’s conceded given pay, total assets, or expert experience. This status opens ways to high-risk, high-reward adventures.

- Requires a top-level salary or total assets.

- Awards admittance to private speculation choices.

- Implies more monetary gamble and expected return.

Private Equity Firms

Confidential value firms put resources into organizations to develop them. They center around further developing execution before selling for a benefit. These organizations offer capital and mastery to help organization esteem.

- They put resources into both laid-out and developing organizations.

- They want to build benefits and sell for a return.

- Confidential value can drive development and market extension.

Networking with Angel Investors

Networking with private supporters opens entryways for new open doors. These financial backers offer subsidizing and important direction. Building solid associations can drive your business forward.

- Go to industry occasions and pitch contests.

- Make a convincing, clear field-tested strategy.

- Cultivate long-haul connections for progressing support.

Investing in Companies Collaborating with Viziv Technologies:

Putting resources into organizations working together with Viziv Technologies can guarantee. These organizations work with state-of-the-art energy arrangements. Associations with Viziv could open ways to imaginative ventures.

Putting resources into them might offer high development potential. The coordinated effort centers around practical energy headways. These associations could prompt forward leaps in power transmission. Research is fundamental before financial planning. Investigate their innovation and plans for better choices.

Equity Crowdfunding

Equity crowdfunding permits people to put resources into new companies or organizations. It allows individuals an opportunity to claim a piece of developing organizations. This model democratizes money management and subsidizing.

- Financial backers own portions of the business.

- It upholds beginning phase organizations with capital.

- Value crowdfunding offers an opportunity for significant yields.

Keeping an Eye on IPO Opportunities

Watching out for Initial public offering amazing open doors is significant for financial backers. Initial public offerings offer early admittance to promising organizations. By financial planning early, you might acquire critical returns. Observing Initial public offerings assists you with remaining ahead on the lookout.

Industry ETFs and Mutual Funds

Industry ETFs and common assets permit financial backers to target explicit areas. They offer openness to businesses like innovation, medical care, or energy. These venture choices pool cash to put resources into different organizations. They are perfect for broadening portfolios while zeroing in on specific enterprises.

Emerging Opportunities and Challenges

Emerging opportunities open doors are molding the fate of enterprises. Innovations and markets are making development potential. Developments carry new opportunities for organizations to flourish.

Challenges like contests and guidelines emerge. Organizations should adjust rapidly to remain ahead. It is likewise becoming urgent to Track down the right ability. The key is offsetting development with risk to the executives. Embracing change can prompt progress in a powerful world.

Limited Transparency

Limited transparency happens when data isn’t completely shared. It can cause disarray and doubt. Individuals might understand left or misguided. This absence of transparency can influence direction. It frequently occurs in associations or frameworks with muddled rehearses.

Restricted straightforwardness can hurt connections and responsibility. Full straightforwardness constructs trust and energizes genuineness. False impressions and distrust develop.

Illiquidity

Illiquidity alludes to resources that are hard to rapidly sell. It can make it hard to get to reserves when required. These resources could set aside some margin to change over into cash. Illiquidity is a typical worry in ventures like land or collectibles.

High Risk

High gamble includes vulnerability and the chance of losing speculations. It commonly applies to unstable business sectors or new pursuits. While the potential for high rewards exists, the peril is critical. Financial backers should cautiously evaluate their capacity to bear risk before committing.

High Growth Potential

High Growth Potential alludes to valuable open doors with critical extension. These valuable open doors guarantee fast improvement in practically no time. Ventures like innovation and sustainable power are perfect representations.

Interests in high-development areas can prompt huge returns. The potential for development and market request drives development. Technologies frequently lead to leap forwards and market shifts. Organizations with high development potential can rule businesses. Perceiving these potential open doors early can bring extraordinary prizes.

Impact Investing

Impact investing money management centers around creating positive social and natural change. It consolidates monetary gets back with significant effect. This approach upholds organizations that affect the planet.

- It goes for the gold and social great.

- It upholds manageable and capable ventures.

- It addresses worldwide difficulties while acquiring returns.

Conclusion

Putting resources into Viziv Technologies could be an interesting and open door. Their attention to remote energy arrangements shows extraordinary potential. The organization’s advancements are expected to change the energy area. Notwithstanding, every speculation accompanies gambles.

Research their advancement and plans completely. Remain informed about market patterns and technology progressions. Assuming you trust in their vision, it very well may be worth considering. Continuously contribute admirably and look for proficient exhortation when required.

FAQ’s

Might I At Any Point Put Resources Into Viziv Advances?

Indeed, you can yet check if they acknowledge public speculations.

What Are Viziv Advances’ Venture Choices?

Choices might incorporate confidential subsidizing or investment.

Is Viziv Innovations A Public Organization?

No, they are exclusive and not public.

What Are The Dangers Of Putting Resources Into Viziv Advances?

Gambles incorporate market unpredictability and innovation reception challenges.

How Might I Access Funding Potential Open Doors With Viziv Advancements?

Investigate private subsidizing organizations or contact the organization straightforwardly.

What Is Viziv Advances’ Market Potential?

Their true capacity is solid, zeroing in on feasible energy arrangements.